Published in Waste Management & Research, two of SCS’s most experienced MSW experts, Dave Ross and James Law, cover the MSW evolution and forecast conditions and practices to expect in the next 40 years. Their paper is a mix of facts and sage opinions highlighting some significant and interesting milestones as solid waste management transformed from the 80s to today’s rapidly changing infrastructure and processes.

Ross and Law close their article with speculations on how solid waste management might evolve further by 2063.

Additional Solid Waste Management Resources:

EPA is hosting a free workshop in January on landfill monitoring and emissions. The workshops are scheduled twice, over half-day sessions. These sessions will include presentations highlighting the latest technological developments for monitoring and measuring landfill gas emissions.

Dates and Times: Register once for both sessions.

If you have any questions, please contact Shannon Banner at or John Evans at .

Co-authors: Karen Luken of Economic Environmental Solutions International, an SCS consultant with Krista Long, Mike Miller, Anastasia Welch of SCS Engineers.

In 1987, the Mobro barge was carrying six million pounds of New York garbage. Its final destination was North Carolina, but the state turned it away. The Mobro barge spent the next five months adrift – rejected by six states and three foreign countries. The plight of the “Garbage Barge” was covered by the mainstream media throughout the summer. This unprecedented attention to trash generated a heated national debate about landfill capacity and recycling to reduce the municipal solid waste (MSW) stream. This dialogue swiftly and permanently transformed recycling in the U.S.

Between 1988 and 1992 alone, the number of curbside recycling programs increased from 1,050 to 4,354. Today, 49 U.S. states ban at least one product from landfill disposal, and twenty-seven states and the District of Columbia have at least one mandatory recycling requirement. The U.S. recycling rate has steadily increased from the Garbage Barge era; by 2017, the U.S. recycling rate reached 35.2 percent, with more than 94 million tons diverted from landfill disposal (67 million tons recycled and 27 million tons composted).

The U.S. was becoming increasingly proficient at collecting recyclables; however, our performance in domestically remanufacturing these resources into valuable commodities was less than stellar. China was the main destination for U.S. recyclables for most of the early twenty-first century. A number of factors contributed to this, including:

By 2018, China was the top importer of U.S. fiber recyclables, buying 2.73 million tons of U.S. corrugated cardboard during the first half of 2018 and 1.4 million tons of all other U.S.-sourced recovered fiber during the same time. The U.S. became dependent on China to process fiber recyclables, which contributed to the closure of 117 American fiber mills and the elimination of 223,000 jobs since 2000.

Sending plastics to China also impeded the U.S. progression of advanced plastic-recovery technologies, such as gasification and pyrolysis. Products created by these technologies can have a market value that exceeds the cost of collection and processing. This was not always the case when selling plastics to China, as this market could be highly volatile. Even with unpredictable revenues, recycling companies perceived China as an eternal end market for their plastics. With China basically locking up the plastic supply chain, advanced plastic recovery technologies in the U.S. could not secure sufficient quantities of feedstock and, consequently, could not demonstrate financial viability for commercial-scale facilities.

Not only did China enthusiastically accept our recyclables, but they also turned a blind eye to the large quantity of trash (contamination) mixed in with the recyclables. This lenient policy validated the U.S. preoccupation with collecting as many recyclables as possible without really considering their quality, potential to become a valuable commodity or the carbon footprint created by using fossil fuels to transport them halfway around the world. Some in the environmental community began to question the net ecological impact associated with transporting recyclables to developing countries for remanufacturing, especially with the limited environmental regulations in these countries related to processing them into a new product. However, state recycling goals are typically based on the quantity of materials collected (rather than if they actually become a marketable product), and local recycling programs were only turning a small profit, or barely breaking even. Thus, no one wanted to “rock the boat.”

However, in 2018, China introduced the “National Sword” that almost sunk the U.S. recycling boat for the short term. The National Sword banned many scrap materials from entering China and required other materials to meet an extremely strict (low) contamination level of only 0.5%. To put in perspective, contamination rates of U.S. recyclables before processing (directly after they are collected) can reach 25% or higher. Processing removes some of the contaminants, but not typically down to 0.5%. After the National Sword, U.S. recycling companies started looking for new markets in other Southeast Asia countries. However, one by one, Vietnam, Thailand, Malaysia, and India also shut their doors by introducing new restrictions on waste imports. So far, there are few signs that any of these countries intend to relax their standards on contamination levels again.

In the short term, there is no question that the National Sword severely disrupted recycling in the U.S. The Chinese market for recyclable commodities was greater than the next 15 markets combined, leaving the U.S. with little in the way of backup to accept this commodity. Thousands of tons of recyclables are now in a landfill rather than becoming a new product. Some municipalities have stopped collecting recyclables (or specific items) altogether, and many more, both public and private, have been stockpiling collected materials in the hope that markets return.

In the long term, the National Sword may be the most significant catalyst to transform recycling since the Garbage Barge started its journey over 30 years ago. In 2019, seventeen North American paper mills announced an increase in their capacity to process recycled paper. Also, and somewhat ironically, Chinese paper companies have begun investing in North American mills because they could not import enough fiber feedstock. Experts anticipate the domestic market for fibers mills to improve for at least another three years.

Chemical companies have also begun investing in advanced plastic recycling technologies, improving recycling systems, and creating bio-based polymers since 2018. In April 2019, Brightmark Energy announced the closing of a $260 million financing package to construct the nation’s first commercial-scale plastics-to-fuel plant, which will be located in Ashley, Indiana. The plant is in a testing phase, and Brightmark anticipates bringing the facility to production-scale in 2021. Now, rather than using fossil fuels to ship plastics to China, more than 100,000 tons of plastics from Indiana and the surrounding region will become feedstock to produce fuel and other intermediate products.

While the U.S. recycling industry was busy making a comeback from the National Sword industry-wide disruption, in came another setback in the form of the 2020 global COVID-19 pandemic. Shelter-in-place orders began in March 2020 in many states, which resulted in families spending more time in their homes than ever before. As of August 2020, many businesses, schools, and governmental entities are still allowing or requiring their stakeholders to work or learn remotely from home.

This work or learn from home phenomenon has resulted in massive increases in MSW and recyclables placed at the curb for collection. From March to April 2020 alone, U.S. cities saw a 20% average increase in MSW and recycling collection tonnage. Struggling restaurants have to offer takeout and delivery services, which is further contributing to a rise in paper and plastic packaging waste. COVID-19 restrictions such as mask mandates have resulted in higher amounts of personal protective equipment in the waste stream, and many items that previously could have been recycled are now discarded due to sanitary concerns.

The higher volumes of MSW and recyclables encountered at the curb during a pandemic present both challenges and opportunities. Challenges include budget cuts due to lower tax revenues, adequately staffing and ensuring the safety of waste-handling employees, and preventing the spread of COVID-19 through the waste stream. During this unprecedented time where municipalities face complex decisions on how to manage their MSW, the opportunity for innovation within the solid waste industry could not be greater.

Cities have begun to “right-size” their recycling systems by evaluating the usage of community recycling containers and reducing/redistributing containers to maximize the quantity of recyclables each site receives. Communities are evaluating curbside recycling programs to increase efficiency, and decreasing contamination is a priority. “When in doubt, throw it out,” has replaced campaigns such as “Recycle more, it’s simple.”

Cities are embracing the concept of public-private partnerships with their recycling processors as they recognize the vital and interrelated role of both the public and private sectors in recovering recyclables. Lastly, the U.S. is beginning to drive manufacturing and end-use markets domestically to stimulate demand for recyclable materials – materials for which we have become so effective at collecting.

There is little doubt that through leadership, innovation, and strategic planning, cities will continue to help lead the way on recycling to achieve landfill diversion and provide for a more environmentally and financially sustainable solid waste management system for the next 30 years.

Do you have NSPS or EG sites per the new definitions of “new” and “existing”?

Does your EG site have any upcoming planned or permitted expansions, or will it be commencing construction on an expansion permitted after July 17, 2014?

Will you need to submit/resubmit Design Capacity and NMOC reports to establish your sites status as subject to the new NSPS? Over, or under 34 Mg/year of NMOCs?

Are you a candidate for Tier 4? In the closed landfill subcategory?

For EG sites contact the SCS state representative by sending a request to

SCS Engineers will be publishing Pat Sullivan’s Technical Bulletin Summary of Final NSPS/EG Rules for Landfills as soon as it is published in the federal register. Meanwhile, please contact your SCS Project Manager or for answers to your questions or advice. Follow SCS Engineers on your favorite social media site or check our events for new presentations, publications, and webinars explaining the rules in more detail.

The Solid Waste Association of North America (SWANA) Applied Research Foundation released a report concluding that: a significant amount of additional food waste processing capacity will be required to achieve national, state, provincial, and local food waste diversion goals. The report also emphasizes the need for local decision-making in selecting and implementing those food waste diversion programs.

…a significant amount of additional food waste processing capacity will be required to achieve national, state, provincial, and local food waste diversion goals. The report also emphasizes the need for local decision-making in selecting and implementing those food waste diversion programs.

The report goes on to say that interest in recovering food waste from municipal solid waste is growing to meet goals established by the U.S. Environmental Protection Agency and U.S. Department of Agriculture, but many major metropolitan areas lack the infrastructure to manage the ability to meet the established goals. Two examples were cited:

Several states, including Massachusetts and Connecticut, condition their food waste diversion requirements on the ability of generators to access adequate capacity within a certain distance.

Speaking as SWANA’s Executive Director and CEO David Biderman stated:

We believe that Americans need to rethink how food is handled before it is considered waste, to divert it into programs to feed people, and to find other productive uses for food as food. Once it becomes waste, however, municipal decision-makers, working with their processing partners, need to determine how to best manage the material.

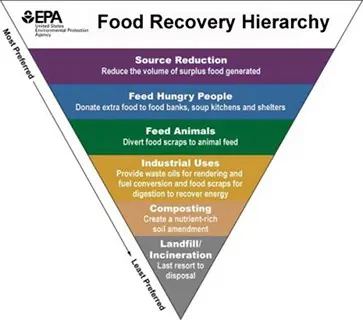

The SWANA report focuses on the effects of food recovery at the two lowest tiers of the hierarchy – composting and landfilling/incineration. The report concludes that food waste diverted from landfill operations has the potential to be processed at composting facilities. Then, going on to say that anaerobic digestion (AD) and co-digestion at wastewater treatment facilities are also likely destinations for diverted food waste.

Jeremy O’Brien, Director of the Applied Research Foundation, noted:

The food recovery hierarchy does not apply universally; an analysis of greenhouse gas impacts based on local data and conditions is needed to identify the best food scraps management options for a specific community.

The report encourages solid waste managers to perform a life cycle analysis of economic and environmental costs and benefits based on local needs, system capabilities, and data to identify the most effective ways to manage food waste at the local level.

SCS Engineers and SWANA are both long-time advocates for local decision-making in establishing programs to collect and manage municipal solid waste.

Related articles:

Infrastructure Week (May 16–23) is a national week of events, media coverage, education, and advocacy efforts to bring the state of the nation’s infrastructure to the attention of all Americans. Forester Media, the publisher of MSW Management magazine, is an Infrastructure Week affiliate. John Trotti, MSW Managing Editor recently surveyed Jim Walsh, P.E., BCEE, President and CEO of SCS Engineers and long-time friend of the magazine on the topic. Jim is first out of the blocks to answer the four questions John asked of respondents from MSW and Forester’s other publications, Business Energy, Erosion Control, Grading & Excavation Contractor, Stormwater, and Water Efficiency.

MSW Management (MSW): Which infrastructure projects should be given priority? Roads and bridges? Dams and levees? Water supply? Electrical grid? Waste management?

James Walsh (JW): Typically public safety, cost, and benefit determine the priority for infrastructure projects, and different political jurisdictions have different priorities. Where highways and bridges are new but waste management facilities are old, the priority might be waste management facilities, and vice-versa. Some types of infrastructure are more amenable to private sector solutions, which can allow the government to focus on other types of infrastructure. The trend in waste management, for example, has been to rely on the private sector in the last decade

Each segment faces difficult challenges; the most significant is funding. Waste management does not necessarily have priority over other projects, but has progressed by regionally identifying the infrastructure necessary. Thus, each region avoids the pitfalls of competing for funding with other regions and other projects.

SCS Engineers focuses on waste management, but there are opportunities to interact with other segments in sustainable ways. For instance, we have energy clients who supply coal ash to specialty cement companies who use it to make “green” cements that last longer in applications such as road construction. We design and construct facilities that take the byproduct gases from the decomposition in landfills to generate electricity reducing their dependence on fossil fuels, or directly use the gas for energy to power wastewater plants simultaneously cleaning and conserving water. We find ways to safely redevelop contaminated property supported by existing infrastructure, thus reducing the need to build new infrastructure.

In short, we work toward helping clients find sustainable solutions to infrastructure projects.

MSW: Is there a solution to long-term infrastructure funding?

JW: With respect to the waste management infrastructure, waste systems require significant capital investment in land, equipment, facilities, and infrastructure. While many governments have decided to rely on private industry instead of financing new governmental facilities, others have become much more sophisticated in adopting private sector approaches to financing. Pro-Forma Economic Life-Cycle Models can assist governmental entities to identify the critical variables that can impact the success of an infrastructure project. Moreover, economic models evaluate how various components of a waste system and variable assumptions integrate together into a sensible approach. Pro Forma Economic Models allow for a careful analysis of the life-cycle costs and potential revenue sources and identify factors that will influence the waste system costs and demonstrate how to adequately and equitably fund the system. These Models provide different scenarios and eliminate options that are not financially feasible or do not fit a region’s short- and long-term needs or priorities. Sensitivity analysis can be conducted to understand better the impact these variables have on capital costs, operating expense, and the overall system economics. By assessing the economic and regional benefits first, we can focus on designing and building infrastructure solutions that are safer, longer lasting, and affordable. Other benefits include adjusting the Model if there is a major change in the commodity market, such as plastics’ recycling is experiencing now and when considering the use of new technologies.

Every industry segment and every region have a different blend of socio-political conditions, geography, and monetary resources—we assess and design to their particular needs. Adopting new waste management technologies, such as anaerobic digestion or waste diversion, as part of an overall waste management program can be integrated into the Model to study how, and if, they sensibly integrate within the existing program. New technologies are typically more expensive than mature technologies such as recycling facilities and landfills, but that condition alone is not why they are considered valuable to a region. The framework considers elements key to integrating anaerobic digestion for example into a long-term program. Capital investment, a significant centralized source of high-quality organic waste, power costs and economic utility incentives, limited land suitable for composting, lack of conventional waste-to-energy facilities, or a ban on organics disposal in landfills are some of the considerations.

Many states are developing organics diversion initiatives, discouraging or banning organics from landfills; they will want to develop separate capacity for diversion within their overall program to build a sustainable plan for the long-term. In some states there is plenty of environmentally sound landfill capacity, recycling facilities have adequate capacity, and the socio-political climate has different ideals. What works in Iowa might not be suitable for California.

MSW: What kind of harm is the current state of our infrastructure doing to the economy and the community?

JW: Every four years, the American Society of Civil Engineers releases a “Report Card for America’s Infrastructure” depicting our nation’s infrastructure condition and performance. In a traditional school report card format, individual infrastructure segments are assigned letter grades—solid waste has the highest grade of B- in the most recent report published in 2013. The waste management infrastructure in the United States is robust, diverse, and significantly supports our economy and communities by providing safe and cost-effective management of the materials that we discard on a daily basis.

MSW: What can various government entities—from local to Federal—do to attract private sector support and investment?

JW: In the United States, private solid waste facilities manage 75% of the municipal wastestream. The waste management industry has many examples of public/private partnerships and significant investment by the private sector. Just look at firms like Waste Management Inc., Republic Services Inc., Waste Industries, Waste Connections, WCA Waste Corporation, Covanta, and Wheelabrator, which own and operate numerous landfills, compost facilities, waste-to-energy facilities, transfer stations, processing facilities, alternative technologies, and hauling companies. These facilities require significant private investment. Allowing private industry to participate in the management of waste management infrastructure brings needed fiscal discipline and accountability to the overall waste system infrastructure.

The private sector is attracted to markets that are predictable and that provide an appropriate return on investment. Jurisdictions with a reputation for making sudden unpredicted changes in regulations that adversely affect the return on investment will find it difficult or impossible to attract private sector support.

The waste management sector and SCS Engineers have seen our share of magic technologies that are literally too-good-to-be-true, yet somehow attract governmental support both financial and otherwise. It is fine for government agencies to provide grant support for research related to promising new technologies, but adopting an unproven technology as the sole means of waste management is inviting a public health crisis. Private sector investment is not attracted to jurisdictions that have unrealistic expectations.

About James Walsh, PE, BCEE, President and CEO of SCS Engineers

Jim has worked at the forefront of sustainable waste management for more than 40 years. He has authored numerous publications, technical support documents, presentations for the USEPA, US DOE, the Gas Research Institute while serving the Solid Waste Association of North America (SWANA), National Waste and Recycling Association (NWRA), and the Environmental Research and Education Foundation (EREF), among others.

SCS Engineers along with Waste Management, Republic Services, Advanced Disposal, National Waste & Recycling Association, Solid Waste Association of North America, The Sanitation Districts of the County of Los Angeles, and other consultants have submitted additional comments to the U.S. Environmental Protection Agency (USEPA), Fuels & Incineration Group, Sector Policies and Programs Division regarding the Supplemental Proposal for the New Standards of Performance (NSPS) for Municipal Solid Waste (MSW) Landfills and the Proposed Emission Guidelines (EG).

The USEPA solicits comments from industry, state officials and other organizations to clarify key points in proposed policy prior to enacting the policy. Although the Agency is not required to consider additional comments after the closing period for such comments, these solid waste industry participants wanted to provide additional findings supporting portions of the policies and guidelines and asking for clarification in areas where there appears to be inconsistency with other federal rules or a lack of data.

The eighteen-page letter was submitted on January 22, 2016, to Ms. Hillary Ward. Since last Friday inclement weather has forced a closing of Federal Agencies in the Washington, D.C. region.

Click for SCS Engineers compliance information.

Click to contact Pat Sullivan, SCS National Expert on EPA Landfill Clean Air Act; NSPS/EG

John F. Hartwell, Ph.D., PE., CHMM, and Senior Consultant at SCS Engineers recently successfully defended his dissertation and earned his Ph.D. An abstract of Dr. Hartwell’s dissertation follows:

METHODOLOGY FOR ASSESSING MUNICIPAL SOLID WASTE USING A LARGE-DIAMETER BOREHOLE

LTC John F. Hartwell, Ph.D., P.E.

University of Nebraska, 2015

Municipal solid waste (MSW) landfills are permanent repositories of society’s non-hazardous wastes. Landfill facilities are becoming harder to site, resulting in increasing pressure to maximize the use of available airspace. Increasingly, this results in developing additional airspace by way of vertical expansion. This expansion imparts greater stress on the landfill mass and the containment infrastructure.

The engineer’s understanding of the geotechnical properties of MSW has been limited to sampling of relatively shallow test pits and reconstitution of disturbed MSW samples in the laboratory. Deeper assessment using small diameter borings is difficult and produces poor low volume samples for ex-situ testing. Some researchers have synthesized MSW with obvious limitations. Landfill failures have provided opportunities for back calculation of MSW properties including shear strength, but these estimates are based on limited understanding of unit weight and moisture content with depth.

The recent trend for the harvesting of methane produced by the anaerobic degradation of MSW has resulted in the need for nearly full-depth, large-diameter, landfill gas collection wells. Prior to completion, these boreholes provide excellent opportunities for directly observing and measuring the condition of MSW in its buried, variably degraded state at depths that are far greater than previously accessible.

The large diameter MSW gas well borehole assessment methodology presented in this paper is shown to be an efficient and valuable means for characterizing MSW. This means that the cost of the assessment is relatively low as the drilling costs are negligible and therefore limited to the cost of labor to sample and perform field observation and laboratory testing. The assessment methodology, which includes scaled full coverage photography and videography, allows precise analysis of a number of geotechnical properties such as wet and dry unit weight, moisture content, specific gravity, void ratio, % saturation of MSW and buried soil layers throughout the depth of the borehole. Further, MSW constituents and biologic degradation can be measured. The orientation / alignment of tensile reinforcement within the waste mass is readily observable. Zones of perched leachate and the effects of mechanical creep on borehole diameter can also be measured.

Contact John Hartwell or Contact SCS Engineers

Learn more about MSW Landfill Services from SCS.

SCS Engineers and their clients appreciate the support. The National Waste & Recycling Association (NWRA) and the Solid Waste Association of North America (SWANA) sent the Environmental Protection Agency (EPA) supportive comments on the proposed revisions to the Research, Development and Demonstration (RD&D) Permits Rule for Municipal Solid Waste Landfills (80 FR70180, November 13, 2015).

EPA’s proposed extension to the RD&D Rule would afford landfill owners the opportunity to continue to operate and develop new data and information that would influence future decision-making by regulators and industry alike. The time extension will provide additional time to help landfill owners evaluate and realize the financial value of the RD&D projects, thus increasing landfill owners’ confidence in implementing related large scale projects. These investments would be for the design, construction, additional monitoring and data collection and reporting that accompany long-term research projects, such as those associated with bioreactor landfills.

The RD&D rule provides the ability to obtain data on best practices to address both the advantages and challenges associated with bioreactor landfills. Operating these types of landfills have many advantages, they are not without their challenges. A bioreactor landfill is much more complex than a typical landfill.

NWRA, SWANA, and SCS Engineers believe this proposed rule will promote new research demonstration projects and support the continued research at existing projects so that EPA will have the information necessary to consider changes to the MSW landfill operating criteria.

DDC Journal recently published an interesting article by Pat Sullivan, “Developing power plants that reduce environmental impacts.” http://viewer.zmags.com/publication/097d62a6#/097d62a6/24

Pat Sullivan, BCES, CPP, REPA, is a Senior Vice President of SCS Engineers and our National Expert on the Landfill Clean Air Act and the New Source Performance Standard (NSPS). Mr. Sullivan has over 25 years of environmental engineering experience, specializing in solid and hazardous waste-related issues.