Co-authors: Karen Luken of Economic Environmental Solutions International, an SCS consultant with Krista Long, Mike Miller, Anastasia Welch of SCS Engineers.

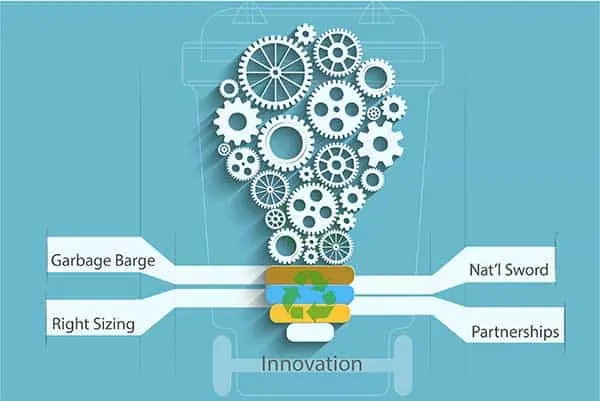

In 1987, the Mobro barge was carrying six million pounds of New York garbage. Its final destination was North Carolina, but the state turned it away. The Mobro barge spent the next five months adrift – rejected by six states and three foreign countries. The plight of the “Garbage Barge” was covered by the mainstream media throughout the summer. This unprecedented attention to trash generated a heated national debate about landfill capacity and recycling to reduce the municipal solid waste (MSW) stream. This dialogue swiftly and permanently transformed recycling in the U.S.

Between 1988 and 1992 alone, the number of curbside recycling programs increased from 1,050 to 4,354. Today, 49 U.S. states ban at least one product from landfill disposal, and twenty-seven states and the District of Columbia have at least one mandatory recycling requirement. The U.S. recycling rate has steadily increased from the Garbage Barge era; by 2017, the U.S. recycling rate reached 35.2 percent, with more than 94 million tons diverted from landfill disposal (67 million tons recycled and 27 million tons composted).

The U.S. was becoming increasingly proficient at collecting recyclables; however, our performance in domestically remanufacturing these resources into valuable commodities was less than stellar. China was the main destination for U.S. recyclables for most of the early twenty-first century. A number of factors contributed to this, including:

By 2018, China was the top importer of U.S. fiber recyclables, buying 2.73 million tons of U.S. corrugated cardboard during the first half of 2018 and 1.4 million tons of all other U.S.-sourced recovered fiber during the same time. The U.S. became dependent on China to process fiber recyclables, which contributed to the closure of 117 American fiber mills and the elimination of 223,000 jobs since 2000.

Sending plastics to China also impeded the U.S. progression of advanced plastic-recovery technologies, such as gasification and pyrolysis. Products created by these technologies can have a market value that exceeds the cost of collection and processing. This was not always the case when selling plastics to China, as this market could be highly volatile. Even with unpredictable revenues, recycling companies perceived China as an eternal end market for their plastics. With China basically locking up the plastic supply chain, advanced plastic recovery technologies in the U.S. could not secure sufficient quantities of feedstock and, consequently, could not demonstrate financial viability for commercial-scale facilities.

Not only did China enthusiastically accept our recyclables, but they also turned a blind eye to the large quantity of trash (contamination) mixed in with the recyclables. This lenient policy validated the U.S. preoccupation with collecting as many recyclables as possible without really considering their quality, potential to become a valuable commodity or the carbon footprint created by using fossil fuels to transport them halfway around the world. Some in the environmental community began to question the net ecological impact associated with transporting recyclables to developing countries for remanufacturing, especially with the limited environmental regulations in these countries related to processing them into a new product. However, state recycling goals are typically based on the quantity of materials collected (rather than if they actually become a marketable product), and local recycling programs were only turning a small profit, or barely breaking even. Thus, no one wanted to “rock the boat.”

However, in 2018, China introduced the “National Sword” that almost sunk the U.S. recycling boat for the short term. The National Sword banned many scrap materials from entering China and required other materials to meet an extremely strict (low) contamination level of only 0.5%. To put in perspective, contamination rates of U.S. recyclables before processing (directly after they are collected) can reach 25% or higher. Processing removes some of the contaminants, but not typically down to 0.5%. After the National Sword, U.S. recycling companies started looking for new markets in other Southeast Asia countries. However, one by one, Vietnam, Thailand, Malaysia, and India also shut their doors by introducing new restrictions on waste imports. So far, there are few signs that any of these countries intend to relax their standards on contamination levels again.

In the short term, there is no question that the National Sword severely disrupted recycling in the U.S. The Chinese market for recyclable commodities was greater than the next 15 markets combined, leaving the U.S. with little in the way of backup to accept this commodity. Thousands of tons of recyclables are now in a landfill rather than becoming a new product. Some municipalities have stopped collecting recyclables (or specific items) altogether, and many more, both public and private, have been stockpiling collected materials in the hope that markets return.

In the long term, the National Sword may be the most significant catalyst to transform recycling since the Garbage Barge started its journey over 30 years ago. In 2019, seventeen North American paper mills announced an increase in their capacity to process recycled paper. Also, and somewhat ironically, Chinese paper companies have begun investing in North American mills because they could not import enough fiber feedstock. Experts anticipate the domestic market for fibers mills to improve for at least another three years.

Chemical companies have also begun investing in advanced plastic recycling technologies, improving recycling systems, and creating bio-based polymers since 2018. In April 2019, Brightmark Energy announced the closing of a $260 million financing package to construct the nation’s first commercial-scale plastics-to-fuel plant, which will be located in Ashley, Indiana. The plant is in a testing phase, and Brightmark anticipates bringing the facility to production-scale in 2021. Now, rather than using fossil fuels to ship plastics to China, more than 100,000 tons of plastics from Indiana and the surrounding region will become feedstock to produce fuel and other intermediate products.

While the U.S. recycling industry was busy making a comeback from the National Sword industry-wide disruption, in came another setback in the form of the 2020 global COVID-19 pandemic. Shelter-in-place orders began in March 2020 in many states, which resulted in families spending more time in their homes than ever before. As of August 2020, many businesses, schools, and governmental entities are still allowing or requiring their stakeholders to work or learn remotely from home.

This work or learn from home phenomenon has resulted in massive increases in MSW and recyclables placed at the curb for collection. From March to April 2020 alone, U.S. cities saw a 20% average increase in MSW and recycling collection tonnage. Struggling restaurants have to offer takeout and delivery services, which is further contributing to a rise in paper and plastic packaging waste. COVID-19 restrictions such as mask mandates have resulted in higher amounts of personal protective equipment in the waste stream, and many items that previously could have been recycled are now discarded due to sanitary concerns.

The higher volumes of MSW and recyclables encountered at the curb during a pandemic present both challenges and opportunities. Challenges include budget cuts due to lower tax revenues, adequately staffing and ensuring the safety of waste-handling employees, and preventing the spread of COVID-19 through the waste stream. During this unprecedented time where municipalities face complex decisions on how to manage their MSW, the opportunity for innovation within the solid waste industry could not be greater.

Cities have begun to “right-size” their recycling systems by evaluating the usage of community recycling containers and reducing/redistributing containers to maximize the quantity of recyclables each site receives. Communities are evaluating curbside recycling programs to increase efficiency, and decreasing contamination is a priority. “When in doubt, throw it out,” has replaced campaigns such as “Recycle more, it’s simple.”

Cities are embracing the concept of public-private partnerships with their recycling processors as they recognize the vital and interrelated role of both the public and private sectors in recovering recyclables. Lastly, the U.S. is beginning to drive manufacturing and end-use markets domestically to stimulate demand for recyclable materials – materials for which we have become so effective at collecting.

There is little doubt that through leadership, innovation, and strategic planning, cities will continue to help lead the way on recycling to achieve landfill diversion and provide for a more environmentally and financially sustainable solid waste management system for the next 30 years.